Underwriting, Case Studies

08 Apr 2024

Cash flow underwriting insights from enriched bank data

Author

Michael Jenkins

Product Marketing Lead

📣 Cash flow underwriting Solutions Spotlight

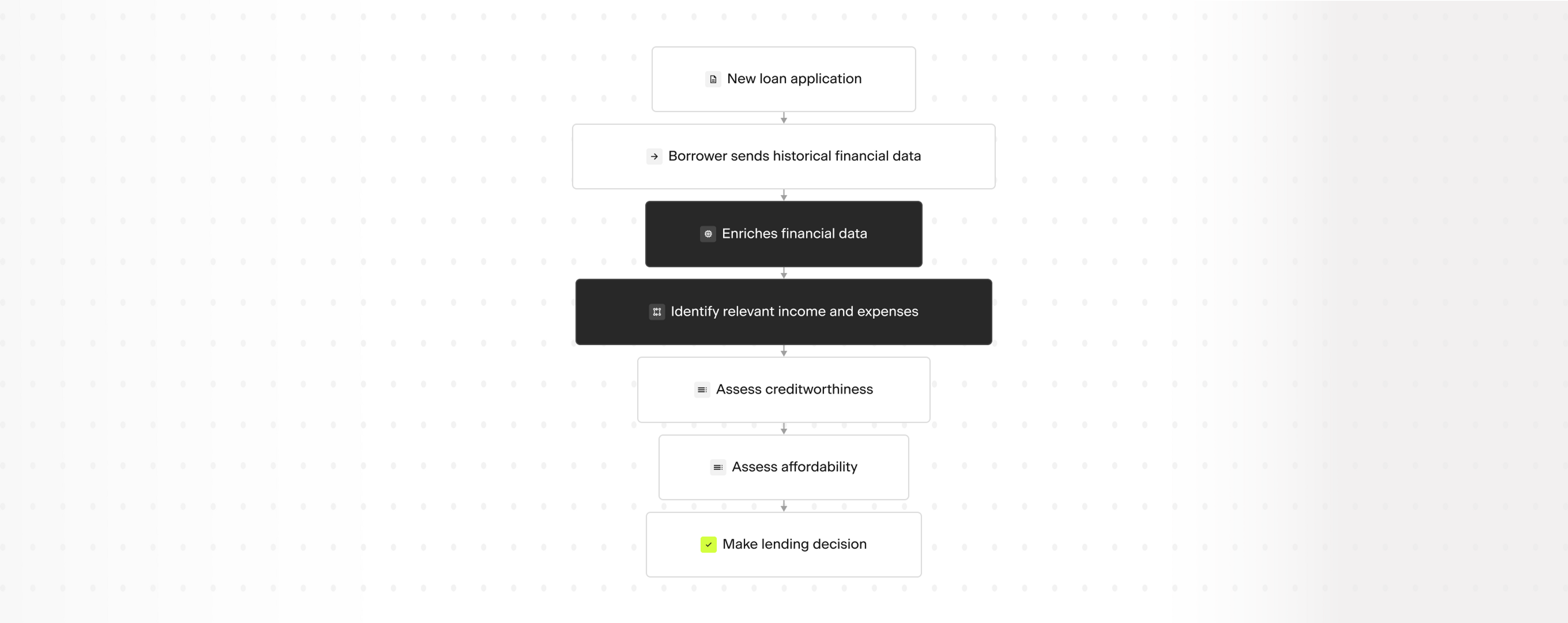

One emerging use case for the clean, enriched and categorized data that Ntropy provides is as a foundation for cash flow underwriting and insights for both businesses and consumers.

What is cash flow underwriting

Cash flow underwriting is the assessment of creditworthiness using bank transactions. It is becoming increasingly popular because of the granular level of information it provides and its real-time availability.

Lenders to both businesses and consumers are integrating the analysis of bank transactions into their credit risk and underwriting flows, either exclusively or in combination with other data sources such as credit bureau data and a businesses financial statements.

However, before lenders can underwrite a businesses or consumers using their bank transactions, the data needs to be cleaned and enriched to provide more context for underwriting.

Bank statements are not going anywhere

Despite the availability of bank data via open banking APIs which are increasingly prevalent across the globe, many borrowers and many lenders still work with traditional PDF bank statements.

For lenders that are still working with PDFs the first step is to extract the key financial details (balances and transactions) from the statements using OCR technology.

Raw bank data is messy

Once bank transactions have been extracted from PDF bank statements or accessed directly through an API, lenders wanting to use it in an underwriting decision discover that it is messy, unstructured and unusable and they need help with cleaning and enriching it.

This is what they use Ntropy for.

Lenders utilizing cash flow based underwriting pass Ntropy raw bank transactions and using can then use our Merchant Enrichment and Categorization products we return clean data that they can use as an input into their credit risk and underwriting models.

With Ntropy, lenders can easily gain deeper insights into a consumers expenses and with our Income Check product, they can quickly and easily identify all income streams a consumer has to help evaluate their risk.

For business lenders, we can quickly identify specific transactions that lenders care about such as a businesses revenues, COGS, other loans and late payments.

Benefits of cash flow underwriting

By utilizing cash flow underwriting and insights lenders are able to;

🔎 Lend more with the same risk

Data gleaned from bank statements can be more granular and provide a different picture of the financial health of a company or business which can mean lenders can approve more loans with the same level of risk.

⭐ Make quicker underwriting decisions

Manually cleaning, enriching and categorizing bank data once extracted from a bank statement is extremely time consuming. Turbocharge your lending decisions by enriching transactions in milliseconds.

📈 Identify risky transactions and behaviours

Categorized bank transactions can help lenders identify important behaviours on top of the categories Ntropy provides such as revenue, NSF fee, loan payment, intra-account transfer, gambling etc.

Who do we work with?

We have customers building cash flow underwriting and insights tools for lenders which utilizes our Merchant Enrichment and Categorization products to better understand the raw bank information they extract.

We also work directly with lenders who have integrated cash flow underwriting into their own underwriting flows such as Wayflyer, Capchase and FounderPath.